Richard Branson made his money when he sold Virgin music to Thorn EMI for 510 million, it was a HUGE deal… and fixed his finances… before that day he admits that he was borderline insolvent.

Interested in taking the next step? Click the button to your right to discover the course contents and agenda

PETER BENNETT

LONDON TRANSLATIONS LIMITED

“ Completely changed the way I think about business! ”

PETER BENNETT

LONDON TRANSLATIONS LIMITED

“ Completely changed the way I think about business! ”

PETER BENNETT

LONDON TRANSLATIONS LIMITED

“ Completely changed the way I think about business! ”

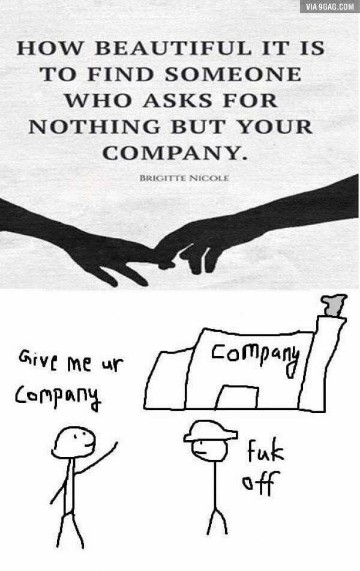

Fact: You don’t make money running businesses. Why?

It’s a common practice to think that you have to work hard running a business to get wealthy… those that have secured real wealth are usually less operationally involved in their business so they have more time to think about the bigger picture

Out of the following people, none of them became rich from running a business… in-fact they only achieved that goal either when they sold their own businesses or acquired and sold another business…

Richard Branson made his money when he sold Virgin music to Thorn EMI for 510 million, it was a HUGE deal… and fixed his finances… before that day he admits that he was borderline insolvent.

Philip Green bought Arcadia Group PLC in 2002 for next to nothing which then became a private company and was de-listed from the London Stock Exchange. He then paid himself a 1.6 billion pound (GBP) dividend shortly after (the largest ever dividend in history).

Theo Paphitis bought La Senza for £1 & 40 packs of Benson & Hedges in 1998 which he then went on to sell for 100 Million in 2006 to Lion Capital.

James Caan sold final economic interest in his recruitment company, the Alexander Mann Group (founded in 1985) in 2007 to Graphite Private Equity in a 100 million management buy-out, led by Rosaleen Blair.

Peter Jones bought and sold generation telecom (founded in 2001) which was sold for millions of pounds within 2 years of starting up (which was a distressed acquisition).

Deborah Meaden made her money from selling her stake in Weststar Holidays. In 2005 she made a partial exit when Weststar was sold in a deal worth £33 million to Phoenix Equity Partners.

Qualifying Leads: Discover why 500k to 5 million revenue companies are in the sweet spot for doing deals. 3 research tools for finding an endless supply of leads and how to pick the right industry (this last tip can boost your exit value by up-to 300%). – PLUS learn why London is almost always the worse place for deal hunting.

11 Psychological Triggers of a Motivated Seller: Understanding these triggers is the key to unlocking the creative deal structures that give sellers what they want, while structuring a deal for no money upfront without borrowing or debt. Once you understand these triggers, then creating a WIN-WIN deal will be effortless. – PLUS “The Perfect Storm” when 3 of these triggers are combined together, you are likely to close the deal on the spot.

Sourcing Motivated Sellers: The worst deals are the ones already listed for sale. Discover 4 unique methods for sourcing motivated sellers who want to deal on your terms (i.e. give you their equity without requiring any of your cash).

"It has been absolutely enlightening – The big part of the weekend for me is just how practical the ideas are – a lot of new tools I can use immediately."

- Doreen & AnitaContacting Motivated Sellers: When contacting motivated sellers what medium to use? Phone? … Email?…Business postal address? … Social media? Nope, none of the above. So what is the best method of contact? Find out on day 2.

Avoid These Businesses: Avoid businesses you cannot explain in a sentence. They are very hard to sell. It’s easier to sell boring sounding companies like air conditioning or cleaning services because more people understand them (this expands your market of potential buyers). Other things to avoid include businesses with excessive bank debentures & overhead intensive businesses (these are hard to fix and profit from).

Acquisition Gold Mine: Revealed the 4 part business sourcing process. How to qualify, contact & close a deal in 4 simple steps – PLUS discover a simple method for finding companies looking for 2nd round funding. Why would you want these leads? Because no one asks for not quite enough money to start a business, so 2nd round funding is a “code word” for fucked it up the first time and the original investors are not interested in sinking more cash into it (aka a very distressed business).

"Highly recommend the Harbour Club to any business owner who wants to build real wealth."

- Nick JamesWhy should you never use accountants, insolvency practitioners, business brokers or lawyers when buying a business? – One person actually decided to attend the course after spending £20,000 on these people which resulted in him not buying a business (a very common mistake).

Accountants & lawyers are counter productive because they have an incentive to put obstacles in the way to prevent the deal from getting done. The longer it drags on the more fees they collect. This often leads to the deal falling through…

I sat next to a lawyer on a flight from Singapore to Spain once while he was talking. He worked at a company that did the legal contracts for large Merger and Acquisition deals. After talking for many hours I decided to ask him how much his company charged clients “about £100,000” he said…What do you do…download a free template off the internet and edit it? I asked half joking…his reply? “Yeah…pretty much…”

After the Harbour Club course we give you a USB with all the legal contracts and documents we use for our deals. These were custom made just for the deal types we are teaching you. These have all been battle tested and refined over the last 15 years. This will be your tool box for closing deals without needing to hire expensive lawyers.

Insolvency practitioners (IP) are usually more concerned with lining their own pockets with fees than paying back creditors…So it won’t be possible to do a no-money-down deal with them.

Forget buying the assets of a dead business at fire-sale prices from an IP. In the Harbour Club we will show you how to find a business before the IP does so you can structure a deal to acquire the assets along with the fully operational business for only £1.

Business brokers bamboozle their clients with exaggerated valuations for their business (to lure them into paying their exuberant listing fees). Once this process has taken place, it is near impossible to get the business owner to accept any reasonable price.

If you use an accountant to help you buy a business you will find they treat the buying of a business like a procurement process.

They will tend to spend a lot of time picking holes in things to try and hammer down the price (and increase the hours they can bill you for) this will destroy any rapport you built up with the potential seller. Rapport is everything, why hammer down the price when you can buy it for £1?

With the Harbour Club strategies you will discover how to buy a business without risking any money (well…not any more than £1 anyway). More importantly, you will be able to do it without needing to pay any of the 4 people mentioned above.

"The most amazing business course – completely changed the way I think about how to run a business and do business – Highly recommend it to anyone!"

- Chris MatthewsDeal Closing Machine: How to close a deal in the first meeting by using the “last man standing” method of negotiation. This will save you many days wasted in travel and meetings. Use the “reverse table side” method to get contract clauses agreed upon quickly with little or no resistance. – PLUS use the Harbour Club “cut and paste” contract clauses to make ironclad contracts effortlessly like a pro.

Negotiation Secrets: Don’t buy any more books on negotiation because Jeremy’s method of negotiation works for closing 6-7 figure deals, and it can be learnt in 20 minutes or less.

Deal Making Mindset: Discover how to slingshot your deal closing rate by up-to 500% by simply using this unique Harbour Club approach. It’s as easy as changing your mindset (hint: it’s the opposite of what everybody else does when approaching an acquisition).

"The course has been absolutely fantastic – I have learnt a lot of things – I will be implementing them this week."

- James HadlyPhone Persuasion: Discover one powerful unwritten rule of telephone etiquette (that even you unknowingly follow) that can turn the tables on your conversation (and get your questions answered). What is the one thing you must say immediately when answering the phone in order to keep control of the conversation? – Find out on day 1.

Stakeholders: The directors, shareholders & key employees might not be the only decision-makers in a business; it could also be advisors, friends or even the owner’s spouse. One word from these invisible company officers and your deal could go south. Learn how to identify and deal with stakeholders to make deals go smoothly.

I Hate Due-Diligence: It’s expensive, boring & time consuming…but necessary right? What if you could get your due-diligence done for free without any extra work…and even better…have it more complete than if you did it yourself or paid £100,000 to hire professionals to do the job for you? Find out how on day 2.

"My biggest take away from the course is the deal structures & and how to structure a deal to buy a business for £1."

- Mohsin Patel

WIN-WIN Deals: Discover how to use the Harbour Club negotiation tactics to figure out the sellers motivations (what they really want). Then use the Harbour Club deal structuring strategies to give it to them without using any capital or debt.

Case Study: How one man’s wife wanting to turn his home office into a nursery landed Jeremy an entire IT company for £1 and how one simple tweak doubled its turnover in 12 months…the best bit? Creative deal structuring…how he then used it as currency to buy a majority shareholding in a much larger IT firm.

Merger Strategies: An often overlooked but very simple and flexible strategy. Discover how you can use one of your no money down deals as currency to buy an equity stake in a much larger business. How to use it as a succession planning tool, or simply just build a much larger business and use a stock market listing as an exit.

Deal Structures: Forget everything you learnt about deal structures from your MBA. These rely heavily on debt. Discover 9 new ways to get more leverage in a deal that does not require any cash or borrowing.

"What I learnt absolutely blew me a way – you are going to learn some awesome techniques you would never have guessed about!"

- Tom CrispKeeping with the crack analogy, often the solution to a crack epidemic is not to go get more crack…the same can be said for business debt.

There is no need to take on debt with the Harbour Club strategies, but we feel the course would not be complete without a mini crash course on the 7 types of leverage that most businesses use to fix short-term cash flow issues.

Bonus Sourcing Tip : If you do lead generation for any of these 7 types of leverage you will probably find some good motivated sellers in those lists (you can sell the leads too) Want an example? – 1 of these 7 types of finance is invoice factoring. Setting up a marketing campaign to generate leads for invoice factoring means you could sell the leads to an invoice factoring company and make a small profit, and be left with a nice list of distressed businesses to approach.

Never Pay Cash: 10 template deal structures you can use to close deals without using any cash – PLUS for people selling on the price earnings (PE) valuation model, discover 5 ways to boost your PE without using sales or marketing.

"Best training course on anything business related that I have ever attended!"

- Dan BradburyInsolvency Secrets: Discover how to buy companies through the Insolvency process using these 5 proven deal templates (100% legal). You will learn how insolvency works; (liquidation, CVA, administration). – PLUS one simple tip to cut your debt in half and inject 6 figures of extra profit into your P&L without any changes to the company operations, sales or marketing.

Killing it Cheaply: Discover how to kill an insolvent company without using insolvency (saving you the £5,000 fee to the insolvency practitioner). This is 100% legal and has full backing by the creditors. We discovered this by accident many years ago, and continue to use it on deals even today.

"In this video from a Harbour Club course back in 2009 – Jeremy shares some of his strategies that use Insolvency law to structure no money down deals. This is part 1"

- Jeremy Harbour"In this video from a Harbour Club course back in 2009 – Jeremy shares some of his strategies that use Insolvency law to structure no money down deals. This is part 2"

- Jeremy Harbour"This course teaches you how to take a company that is in a bit of trouble and instantly turn it into a cash positive company. I have done an MBA & the tools there are nothing to what Jeremy has to offer."

- Nick WintonIf your business turnover is £500,000 or more, then this alone could make back your course fee within a couple of weeks of returning home

Easy Cash Injection: Discover how to take a company with 10 or more employees and inject up-to 15% of their yearly revenue back into the business as cash. It only takes one phone call to do and requires no upfront cash. (It also DOES NOT involve firing anyone, reducing hours, outsourcing or even cutting wages – operationally nothing in the business even has to change).

Financial Engineering: Amazing tactics to uncover profit hidden in your business (without increasing sales). If your business turnover is £500,000 or more, then this alone could make back your course fee within a couple of weeks of returning home.

Personal Guarantee Magic: How to make “Personal Guarantees” disappear almost like magic using this financial engineering strategy (that works on almost all SME businesses). – Case Study: How Jeremy bought a PR company for £1 on the basis he gets rid of their personal guarantees in excess of £85,000 on their overdraft (and fixes their payroll of 17k due a week later). He then made those PG’s disappear like magic without using any of his own money or borrowing, selling the business only months later for $2,000,000 USD to a company in the USA.

"It is an excellent course – I highly recommend it. This is not some text book accountancy by numbers kind of thing or a run of the mill learning… this is nitty gritty, spit and sawdust real world stuff. This is how it is done. Real businesses, real problems and how to fix them."

- Karl WhitfieldWhy Fire Your Best Sales People? : Find out how cutting your sales and marketing team might not only make your business more profitable but actually increase its value when it comes time to sell. Sound ridiculous? Well…it works…the real question should be how to stop the rest of the staff from leaving after this happens. But wait; there is a strategy for that one too…

Vertical Integration: Strategies to transform areas of profit loss in a business into profit gains by using vertical integration. – PLUS How to mine undiscovered profit lying dormant in your database.

The Immortal Business: Discover how to create an invincible business structure. One that is immune to insolvency, litigation & bankruptcy… Protect your assets, intellectual property & your operational infrastructure by exploiting this unique “silo based licensing strategy”.

"Stuart Davis – I would recommend anyone who is an entrepreneur to do the Harbour Club if you can. It’s the best investment you could probably make in yourself and in your business."

- Stuart DavisBullet-Proof Purchase Agreement : How to turn the simple age old purchase agreement into a contract more powerful than anything a lawyer could ever draft, (no legal experience required). This is very out-of-the-box thinking, but it’s so powerful that a friend of Jeremy’s (an insolvency practitioner) working for Baker Tilly, one of the largest accountancy firms in the UK now recommends this strategy to all his clients).

The 51% Myth: Whoever has 51% or more of a company’s shares has complete control over the company…right? WRONG! – Discover one simple tweak you can make to the shareholders agreement that will give you the same power as a majority shareholder even if you only have 1% of the company.

"The best business course I have ever been on bar none."

- Dan TaylorCompete Clause: How to stop the previous business owners from stealing your best staff & customers and going into direct competition with you? Use a “Non-Compete Clause” right? – Nope…let me explain… “Non-Compete Clauses” don’t work anymore, they are a violation of human rights under EU law…and to enforce one requires going to the high court (which will cost £60,000+ and you will probably lose). So what is the solution? Discover one simple strategy & get your hands on a proven contract template you can use that will leave you secretly wishing they do steal your customers.

Trade Secrets: Private equity companies use convertible loans (which can be converted into shares at a time of your choosing) because you have more control legally over the company when it owes you money… But, how to use them to guarantee that you get paid from your deals? All will be covered in the financial engineering section of the course.

Forbidden Actions: Discover 3 things you must never do as a director. Most directors do at least one of these without realising they are breaking the law… Do you? Find out on day 1.

Cash Is King: Discover the 3 step formula for fixing the long-term cash-flow problems in almost any business type. You don’t go bust from a lack of sales, profit or turnover; it’s a lack of cash that will bury you alive. PLUS – Discover how to save a business only weeks away from closing its doors (using Jeremy’s 8 week cash-flow forecast strategy).

The Truth about Redundancy: It’s not as bad as you think…revealed: “The unfair dismissal myth” – PLUS why redundancy might be shockingly cheaper than you expect.

"Steve Edwards – Fantastic location, Fantastic food & Fantastic company. I am really impressed with Jeremy’s approach. The techniques are unique. I am going to use 1 or 2 of the strategies right away as soon as I get back home. I really recommend the course"

- Steve EdwardsCash Flow Metrics : People don’t understand the relationship between cash and profit. The truth is that there is none. Being able to measure cash-flow in a business (not profit) is vital to keep a business healthy, but no such metric or KPI (key performance indicator) seems to exist. Jeremy invented “cash flow metrics” to help measure and improve cash flow. Learn how to unlock the cash hidden in your balance sheet.

Rapid Debt Collection : What if you could collect on most of the company’s debts within 7 days? Would that fix a cash-starved business? Discover one simple but overlooked strategy for being able to collect debts at lighting speed. It’s simple, effective & easy to implement, but you have probably never heard of anyone doing this…

"James & Moran – There are a lot of things we learnt here” “My favourite bit was about how to buy a bank with no money and I wished I had known that years ago” “If you are ever thinking of coming to the Harbour Club then don’t even think twice just come here"

- James & MoranLearning from Mistakes : A wise man learns from his mistakes. A genius learns from other peoples. Case Study: How Jeremy turned one of the first businesses he acquired (a call centre) with a £300,000 hole in the balance sheet into a £150,000 profitable company with a contract with the largest insurance company in the world…then lost it…and sold it for £1… Using the latest Harbour Club course strategies he could have turned that into a 7 figure deal instead of a 1 figure deal. Learn to avoid making this mistake to create a shortcut to your first 7 figure deal.

IPO Windfall Exit Strategy : When selling your company privately, you’ll be lucky to get 2-5 times its yearly profit. If you’re large enough you could use an IPO to exit your shares for up-to 15 times profit. This is an advanced strategy. Jeremy will give you case studies of IPO’s he has worked on.

How Much Is Your Business Worth? Harvard business school has 126 ways to value a business. Only a handful of these are worth using. Learn how to use these models selectively to get the best price for your business during your negotiations.

"Keith Nixon – I am a chartered accountant with an MBA, I have learnt how to create massive wealth for both others and myself from this course, I would certainly recommend it."

- Keith NixonSelling is Buying: Discover 7 ways to source buyers for your business (not including business brokers). Selling a business is a bit like buying one in reverse (so you can re-use a lot of the same tactics from buying one) most importantly you can use the same due-diligence file you produced when buying the business in the first place.

How to Guarantee You Get Paid: When selling a business most deals include some kind of deferral but what is wrong with this model? It very rarely gets paid… Why? Because it implies some kind of warranty and is very hard legally to enforce. It requires going to the high court which will cost £60,000+ and even then you might not win. How to make sure you get paid every penny you are promised and if they don’t pay, how to legally regain control of the company so you can sell it again? Find out in the financial engineering section of the course on day 2.

The Exit – Who is your best customer? Your best customer is the person who buys your business. Discover how to find them…they might be closer to home than you think (hint: your suppliers could all be candidates). PLUS – How to spot things in a business that could be worth more than the business itself (commonly overlooked).

"Martin Norbury – My business helps other businesses scale, one area that was lacking was experience in the SME market for exiting the business. This has been my main take away from the course. This has been an amazing 3 days. Come out here and join Jeremy to see for yourself"

- Martin NorburyA lot of new case studies have been added to the Harbour Club, here is a sneak peak at six new 7 figure deal strategies recently field tested and added to the course:

How to Buy a Bank Without Using any Money : Discover how Jeremy bought a bank in America with a hundred million in assets… For no money upfront (without debt) – PLUS find out how to structure a 100% risk free deal like this yourself. There are more than 7,000 banks in the US… Globally many thousands more… They all have the same fundamental challenges that Jeremy will show you how to solve.

IPO Exit Strategy: The two big drivers for a company valuation are scale and liquidity (ability to buy and sell shares easily). Discover how to correctly structure an IPO to achieve compound growth in these two areas as quickly as possible.

Back Door Listing: An IPO is expensive… Unless you use this little known method. Discover how to do an IPO for 80% less than going through an investment bank or corporate finance company. By using this sneaky (but perfectly legal) back door route to a main market listing.

Virtual Roll-Up 2.0: The same concept as 1.0 (how to buy and sell multiple companies in one deal for 7 figures without even having to own them)… – However a lot has been added to the virtual roll-up strategy recently (from ideas Jeremy has tested out in the field) – For example, a new approach to corporate management and management for generation Y – PLUS a great way to create big companies fast… All this with well established market leading profitable companies (rather than distressed).

Going Global: How to do more cross-border, multi-jurisdiction deals so you are not left at the mercy of your local economy. Time to diversify and protect yourself against geopolitical risk.

Jurisdiction Arbitrage: Jurisdiction arbitrage and the IPO inversion strategy… This is all about using global solutions to maximise value… – An example of one of the many deal types in this category is: 1) Finding an established UK company and 2) Acquiring businesses from emerging markets under its name. Why? – Because a company in the UK gets a better valuation than a company in Asia, but a company in Asia has much easier profits than the UK… So put them together and you get a UK company doing well in Asia that you can sell for over 500% more than you could if they were separate. (Case studies included).

You take a seat at your table. In front of you is your welcome pack.

You take out the branded pen and notebook and take a look at the three separate binders.

#1: All the documents (contracts, white-papers etc) discussed on the course.

#2: A copy of all the slides from the course presentation.

#3: A full set of notes of the course content written by an experienced Harbour Club alumni who has closed a 7 figure deal with this information. (Thanks Bev).

A signed copy of Jeremy’s books (GoDo and Agglomerate). – PLUS 3 more short reads relevant to your new deal making career.

Quick start guide. (Actions to take immediately after the course to get you started on your journey).

1. Example letter of agreement for a structured deal.

2. Example spreadsheet used in cash planning from the financial engineering section.

3. Lead qualifying questionnaire.

4. Due-diligence checklist.

5. All legal documents for an agglomeration (virtual merger 2.0).

6. Calculator spreadsheet used in our exit strategy.

7. White paper about the immortal business structure.

8. White paper about our easy cash injection strategy.

9. Example spreadsheet used in the personal wealth section.

10. Example wording for approaching distressed companies.

11. Sale and purchase agreement.

12. All the documents concerning our exit strategy.

13. Example information memorandum.

14. Engagement letter (proven sourcing letter for finding deals).

15. Plus more.

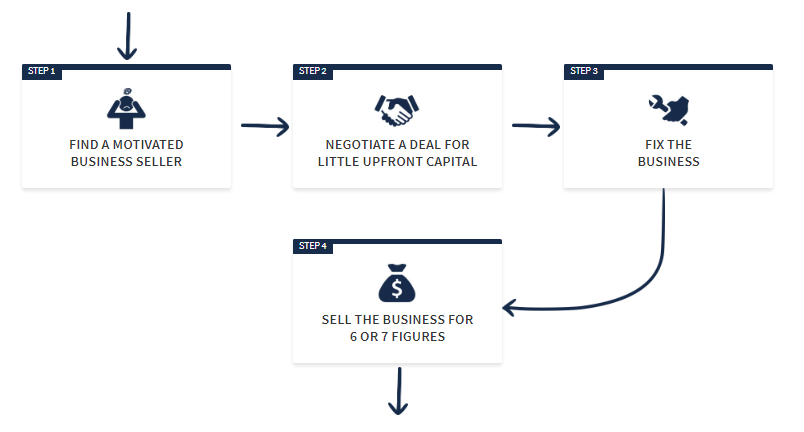

Why do deals at all

What to look for in a deal

Where to look for deals

How to position yourself to attract deals

Why you need businesses not for sale and where to find them

7 techniques that Harbour Clubbers use most to do deals

Passive and active sourcing strategies

Sourcing advise from past delegates to new starters

What is on the USB and how to use it

Plus more

You look at your watch. It’s now 7:00pm.

Time for dinner.

You notice that each table includes someone who has done deals before. You’re glad to hear this will be a feature during all meals on the course.

You now relax after a long day of learning, do some networking, listen as the group shares their stories and experiences and contribute your own.

YAWN… getting tired… You decide to call it a night. You swap contact details with some valuable connections you have been chatting too and you retire to your room for the night.

You arrive for breakfast at 8:30am, your brain lights up from the first caffeine boost of the day, and you network with your fellow members.

Someone mentions that it’s nearly 9:00am and the course will start soon.

Now you’re learning about “deal structures”.

6 strategies for no money down deals (for both distressed and solvent companies).

How to take a stake in a company for £1 and almost immediately sell it back to the owner for 6 figures.

How to make sure you always get paid deferred payments (vendor finance)

And much more

You notice a subtle craving for coffee. You’re in luck. Just in time for a 20 minute break. You grab yourself a coffee, use the rest room, chat with fellow members about the content so far.

What to do and say in a face to face meeting

Legal protection

Exit strategies

How to value a company

How you increase that valuation

Plus much more

You look at your watch, it’s now 1:00pm. Time for lunch.

yum, that tasted good.

Now time to learn about “buying & selling tactics”

From a legal contract perspective how do you actually buy a company?

How to find buyers who will give you the best price

How to buy a bank

plus many more “out of the box” purchase and exit strategies

Your hand is starting to ache from taking all these notes, but don’t worry now it is time for another 20 minute break.

Legal Hacks: How to control a company with a minority stake?

Keeping it Legal: The 3 golden rules you must never breach.

Insolvency Hacks: How to cover your arse when dealing with insolvency.

Due-diligence Hacks:How to use it tactically to fix an insolvent business – add value and speed up a sale – importantly how to make the seller pay for it!

Debt Hacks:Court approved payment plans. Why most fail and how to use them properly to save jobs and rescue a dying business.

and many other cool tricks

It’s now 7:00pm… your brain feels as though it is melting from all the ideas. Thankfully it’s dinner time, so you can relax, eat and spend the rest of the evening networking.

Tip: Although it may be tempting… try and avoid the urge to drink alcohol at this point. Tomorrow is jam packed packed with content, and you need to be sharp the next day.

You wake up with your head swimming in ideas from the previous two days… You sit down for a good breakfast at 8:30am, and offer a quiet smile to the people that could not help themselves the night before and had one too many.

You now prepare for the most intense part of the course… Today is the day that you will learn financial engineering… everything you have learnt up until this point has been building up to this.

It’s this part of the course that makes people leave testimonials like this one:

The day kicks off with:

Cash-Flow Hacks: 9 step structure to fix cash-flow and rescue a business from the clutches of aggressive creditors.

Profit Hacks: Quick ways to boost profits in an struggling business.

Value Hacks: How to think like a shareholder and add massive value to a company.

Personal Guarantee Hacks: How to help a company and director that has them.

Capital Market Hacks: The insider secrets to how capital markets work.

Capital markets? Ouch my head hurts… you can stay… but I am taking my 20 minute break right now…

Now back to learning about advanced “8 Figure Deal Strategies”

8 Figure Hacks: How to list a company to create massive value. (Case Study: 50 million euros in 90 days – all from no money down deals).

Acquisition Hacks: How to use a listed company as a no money down acquisition engine.

Listing Hacks: The strategic use of IPO vs RTO.

Saved by the bell. It’s now 1:00pm. You can enjoy talking about these new strategies with fellow members over lunch. (umm… I like lunch).

Exchange Hacks: Why should you not just select and list on an exchange where you live?

Advice Hacks: Advisors and why they all have to lie to you, and how to read in-between the lines.

Life Hacks: Life after listing, how to make sure you don’t end up with a job.

Time for another 20 minute break. You skip through your phone book taking down some notes of people who might be worth giving a call when you get back from the course.

It’s now time to start learning some wealth management hacks.

As noted by “Epicurus” an ancient Greek philosopher “The acquisition of riches has been for many men, not an end, but a change of troubles”, but isn’t it nice to have a change of troubles? Having the same ones all the time can get very boring.

Now let’s learn the wealth management hacks that will give you an unfair advantage.

Yacht Hacks: How Jeremy bought a yacht for $2,000 a year and how that was paid for by his portfolio income.

Loan Hacks: How you can borrow (at time of writing) up to 3 million euros interest free for a year (yes zero interest).

Private Banking Hacks: How you can make 17% a year (at time of writing) income from blue-chip stock like Apple/Amazon etc

Wealth Hacks: How can you invest 100% of your income to create real wealth, while still living an amazing lifestyle?

Disclaimer: Information is for illustrative purposes only and does not constitute legal or financial advice.

Before we get lost in the troubles of the super rich… what can you do right now?

#1: How to access the power of the “Inner Circle” to find and execute deals (the Harbour Club network).

#2: How to get free masterminding.

#3: How to get free Q&A and chat groups.

#4: How to get direct access to Jeremy for Q&A.

It’s now 5:00pm, the content has finished, but don’t leave just yet.

You now have time to network with your fellow delegates, swap contact information and agree deals to work together on future projects.

You will be added to the course WhatsApp group so you can keep in touch with your fellow members.

1. Deal sourcing – how to find acquisition targets

2.The approach – how to get in front of a potential opportunity

3.The meeting – how to manage the meeting

4.Deal structures – using structured details to avoid paying capital upfront

5.Insolvency law – all the different types and how to use them

6.Financial Engineering – how to make businesses make cash and profit quickly

7.The Exit – how to sell a business for the maximum price quickly and easily.

#1 – Accommodation (UK & USA events only)

#2 – All food/refreshments

#3 – USB key that gives you instant access to all the legal documents and contracts that have cost over £20,000 in legal fees to develop & have been fine-tuned over 12 years of using these strategies.

Note: Due to the addition of guest speakers and updated strategies on live deals this itinerary can be changed at our discretion to add new content.

After course support is 100% free for our members. (It’s not linked to any payment plan).

You get Jeremy’s “Skype ID” to message anytime for advice on deals you’re working on.

You get “members only” bonus content. Including Q&A videos (which you can submit questions for). – PLUS videos with case studies and insights from our members.

You’re invited to the “Inner Circle” which includes the opportunity to join free mastermind groups.

The inner circle is a forum where you can keep in touch with the members from your course, share advice, partner up, post your success stories and motivate each other to break your deal virginity.

This has been very successful. We used to run support from WhatsApp groups however the feedback was that the forum format is much easier to use. Here are some screen shots from our older WhatsApp support groups: (Click on the images below to enlarge them)

"Case Study: How Steve did 3 deals in 2 months (Including one 7 figure deal)"

- Steve Pratt"Case Study: How Paul closed 4 deals in 8 weeks – Paul Seabridge"

- Paul Seabridge"Case Study: 1.2 million sized deal and 49% share for no cash upfront – Beverley Merriman"

- Beverley Merriman"Case Study: 4 deals using the Harbour Club strategies – Lee Johnson"

- Lee Johnson"Case Study: How did Tony grow his company by 15% in 8 weeks"

- Tony Messer"Case Study: How Del closed a deal on the first meeting?"

- Del Thomas"Case Study: 4 deals including an 18 million a year trucking company"

- Chris Isbell"Case Study: How Gauri did a no money down deal on a 156 year old 3.2m turnover company?"

- Gauri Talathi-Lamb"Case Study: Jeanette from Sweden closed 2 deals in less then 3 months"

- Jeanette Holm"Case Study: How Paul closed 2 six-figure deals 10 days after Harbour Club – Paul Seabridge"

- Paul Seabridge"Case Study: How Liam closed his first deal by merging his IT company – Liam Bowmer"

- Liam Bowmer"Case Study: How Richard bought a distressed training company for £1"

- Richard Brady"Case Study: How Craig, who attended the second ever Harbour Club, is now doing deals in the US"

- Craig Boddington"Case Study: Lee closed a deal in 3 weeks by merging two IT businesses. His business is now 7 times bigger since going on the Harbour Club."

- Lee Smith"Case Study: Mark bought a distressed Telecoms company for 85p within 3 months of finishing the course."

- Mark Masiak"Andrew Baynes interview before doing the course"

- Andrew Baynes"Andrew Baynes interview before doing the course"

- Andrew Baynes"Grant McGowan interview after doing the Harbour Club course"

- Grant McGowan"Lee Taylor interview after doing the Harbour Club course"

- Lee Taylor

Dear Jeremy, I hope you are well.

I wanted to thank you again for organising the session last weekend, I took an awful lot from it and found it enormously valuable.

I have just come out of my first merger meeting with a competing coworking space. I listened, I understood their needs I showed them how a merger would fix all their problems and sold them on all the other potential synergies we could work on afterwards. I got them to imagine the press release announcing the merger and the effect it would have on the industry. I got them to see how it would overcome a huge challenge for our industry which is the barrier to exit (eyes lit up at that point). I also introduced a surprise element they didn’t know about which is the potential for the next merger after this one and how I’m the only person who could make it happen. I left them really excited and energised about the prospect. We are meeting to draft a deal next Tuesday.

The other party’s comments were 1. “gosh you really are wise beyond your years” and 2. after I told them I would send them a list of questions to complete before the next meeting so we had some terms of reference “You really have put a lot of thought into this” and 3. when we were shaking hands and parting ways “What a fantastic meeting. I’m really looking forward to Tuesday”

I didn’t know how to structure it until this weekend. He didn’t have a single point of contention to the SPV/holding company the structure, in fact to any of it – He just left feeling fantastic.

I just wanted to let you know I was actioning and that it was working really well.

Thanks again.

PS – Not quite the fastest but 4 days isn’t too shabby!

Kind regards,

Jonathan O’Byrne

CEO – Collective Works

“Wow!! My head is literally spinning, thank you Jeremy for sharing so much of your wisdom and experience. It has been such a valuable and exciting experience. This is not some textbook theory. This is the real, gritty, spit and saw dust. I am stoked to get cracking. Awesome & fun weekend. Thank you!” – Karl Whitfield – Business Owner of MND Health Limited

Endorsement: “I am really pleased I followed my instinct and joined The Harbour Cub, my initial concerns have been lifted and I think this will be the start of a great adventure. Looking forward to working with such a bright group of guys and learning loads. Thanks Jeremy for a great weekend, looking forward to more luxury villas and champagne.” – Kam

"Video Quote: “Best training course on anything business related that I have ever attended” – Dan Bradbury – Owner of Dan Bradbury Ltd – www.danbradbury.com"

- Dan Bradbury

Absolutely outstanding! Worth 10 times the fee.” – Jonathan

Endorsement: “I came with high expectations and all were thoroughly exceeded” – Name withheld – senior M&A person from a division of Microsoft

“Overriding impression was of an event professionally put together and providing excellent value on a number of levels – The concept itself, providing a clear end-to-end process for buying “distressed” companies effectively for no cash up front. A number of useful processes and insights, any one of which could likely have justified the investment in the event. Excellent connections to providers of high value services. Good contacts with other people attending the event. Both venue and catering were to a very high standard.” – Charles Bartholomew – Chartered Accountant – Executive of the Institute for Independent Business (IIB) – www.iib.ws

“Pragmatic, practical and hugely valuable. Thank you Jeremy for packaging so many tools and techniques that make a fast start a possibility. Looking forward to a long term connection and exciting opportunities to share with you. I have done an MBA, the tools there are nothing compared to what Jeremy has to offer” – Nick Winton – Non Executive – www.NicktheNonExec.com

“All I can say is “wow”, with an accountancy and finance background this really hits home to see how business really works. We are now on the verge of our first acquisition which I hope will be the first of many. A new direction in my business life, cheers” – Richard

"Video Quote From Doreen & Anita “It has been absolutely enlightening – The big part of the weekend for me is just how practical the ideas are – a lot of new tools I can use immediately” “You get so many strategies you will get your money back in no time at all”"

- Doreen & Anita"Video Testimonial Quote: “Information you cannot get anywhere else – highly recommended” – Paul Higgs – CEO of Millbank Group"

- Paul Higgs – CEO of Millbank Group

“The course is dead is easy to understand and if you follow it, it works.”

Paul Seabridge – Business Investor

"Nick James: “Highly recommend the Harbour Club to any business owner who wants to build real wealth”"

- Nick James

Endorsement: “Well, what can I say, it’s been an awesome weekend and I’ve learnt a lot. I never knew strategies like these existed and I am looking forward to using them in the coming months.” – Moshin Patel – Barclays Wealth

“Not only did Jeremy actually super-exceed my expectations, it beyond that. We learned strategies here that are not available to anyone. We learned strategies here that only the super-rich have access to.” – Marco Robert – Business Consultant

Endorsement: “What a fantastic life changing few days! Thank you so much for giving us this opportunity to learn from all your mistakes and successes over the last 8 years! Hopefully this might help me bi-pass some of that pain and move quickly onto making some serious money and have fun doing it! Cheers to lots of future win win deals. It all starts here.” – Jamie

“Thanks for an awesome few days. I will have hell to pay on my return as I missed my 20th anniversary (between you and I don’t tell Elaine my wife), I would do it again. Jeremy’s approach has taken my outlook and moved it to a whole new level of understanding that will have a dramatic impact on my business life and those around me. Fantastic life changing experience” – Dan Taylor

"Chris Mathews “The most amazing business course – completely changed the way I think about how to run a business and do business – Highly recommend it to anyone”"

- Chris Mathews

Just a quick thanks – the weekend was awesome. Really worthwhile!

Jeremy was just fantastic, and the info he shared was really smart but put into really actionable steps which should make it easy to make some of the stuff actually happen. I’m already setting some wheels in motion and hope to have done some deals over the coming months.

If ever you need any testimonials or anyone to pass potential attendees onto for references etc I’m happy to do so.

Also just a side point in all the marketing and his online presence Jeremy comes across as a completely different person than he is in ‘real life’ – before the course I wasn’t really convinced the support was there and how much he’d really care, but having met him and heard his story, seeing he’s a really genuine guy and has an amazing back story and ‘why’ etc wish I’d known that before as it would have made committing far easier – sure I’m not the only one, so thought it was worth mentioning.

Thanks again

Dave Gillard

"James Hadly – “The course has been absolutely fantastic – I have learnt a lot of things – I will be implementing them this week”"

- James Hadly

Thank you Jeremy!

Your 4-step process to closing 6-7 figures deals really proves it is far better to work at your business than in your business. Awesome, fully packed course, even added with continuing practical support after the course. On top of all: the agglomeration model, a super wealth creating strategy for SME. Already implementing all learned in real world!

Frank Reijnen

https://www.linkedin.com/in/frankreijnen1/

Endorsement: “What an eye opener! While being aware that some of the things we have learnt are possible I never dreamed that I would feel able & equipped to implement them. A fantastic weekend, learning skills to propel my career & take things to the next level. Now for action!!” – James Hadley – Tax Consultant

Endorsement: “Absolutely amazing! Takes thinking outside of the box to a whole new level. Thank you Jeremy.” – Malcolm Howe – Property Investor

"Mohsin Patel – “My biggest take away from the course is the deal structures & and how to structure a deal to buy a business for £1”"

- Mohsin Patel

To sum up the course one of the most practical and authentically delivered courses I have ever been on. Jeremy tells it warts and all so that you understand the processes and also the reality of making the changes. For someone that is looking to change their career like myself this really opened up my eyes to a new way of looking at business and a way to practically make money. Don’t be embarrassed to say you want to make money resonates. The people I met were outstanding and took part in a way that I found to be truly motivating. I am one day off the course and we have already challenged each other as to next steps with some throwing down the gauntlet and all ready to help one another. I would thoroughly recommend this course to anyone and suggest dust off the old accounts book and read before you attend.

Jamie Levy

Business Investor

https://www.linkedin.com/in/jamie-levy-5032a98/

As I was watching this video I realised that I never updated my harbour club group (Oct 2016) about the deals I did later on, so just thought I’d shoot you a quick summary, maybe useful for future marketing of the program.

My company creamfinance.com (online consumer loans) bought a distressed consumer lender in Mexico (paid EUR80k, got a trading licence, client data base and tax shield worth EUR70k)

We bought a small profitable consumer lender in Spain, this was not a distressed investment but more an acquisition of company which gives me access to a very important market (paid EUR1mil equity, refinanced their EUR0.5mil debt, in return got EUR1.8mil annual revenue with potential to scale 5-10X)

So again thanks for the course, I will drop by at the London event next year, hope to see you there mate!

Matiss Ansviesulis

Co-Founder & CEO of Creamfinance

"Tom Crisp – “What I learnt absolutely blew me a way – you are going to learn some awesome techniques you would never have guessed about”"

- Tom Crisp

“Awesome weekend with some really eye opening jaw dropping moments. Very practical and lots of ideas & strategies to take away and use immediately. Cannot wait to start using everything I have learnt.” – Anita Douglas (Corporate Training)

Endorsement: “Jeremy, he absolutely delivers what it says on the tin, so much crammed into such a relatively small space of time, it is impossible to pick out the best part, too much to choose from until I have been over it several times. Many many thanks.” – Name Withheld

Endorsement: “Just brilliant. So good to be taught by somebody who walks the walk not just talks the talk. Thanks for an enlightening two days.” Chris – Health Businesses Owner

“What an eye opening wonderful weekend this was. I would never have thought that a few small clever techniques & strategies could be so powerful. I cannot wait to get started.” – Tom Crisp – Agricultural Investor

"Stuart Davis – I would recommend anyone who is an entrepreneur to do the Harbour Club if you can. It’s the best investment you could probably make in yourself and in your business."

- Tom Crisp

“Absolutely blown away. The content was awesome. Completely changed the way I’m pitching businesses now. In 8 weeks I’ve got 3 deals on the table.”

Steve Pratt – Business Investor (M&A), property investor, business consultant & corporate financial adviser

“For me definitely exceeded expectations, many many times over. We just came away from it completely infused with a really clear plan about what we needed to do.”

Tony Messer – Investor, Entrepreneur, Speaker, Content Strategist & 5 Star Rated Author

"Dan Taylor – “The best business course I have ever been on bar none”"

- Dan Taylor

“An excellent few days! Lots of great strategies to implement in my current business and those that are to follow. Also a great time to meet new like-minded people.” – Jonathan Heaton – Business Owner at Key Computer Applications Ltd – www.keycomputers.co.uk

“Nothing… absolutely nothing comes even remotely close to the learning that I have taken on-board this weekend. Jeremy is a genius! What he has shared with us will change my life. Thank you for sharing your acres of diamonds.” – Doreen Yarnold – Corporate Training

“Jeremy thank you. Thank you for sharing the secrets of your success with us. The programme is fantastic. I will recommend it to many more people.” – Matt Trimmer (Internet Marketing Consultant) Business Owner of ivantage Limited – www.ivantage.co.uk

“Thanks for an enlightening and enjoyable few days. Cannot wait to start putting it all into practice and building some serious wealth! In the words of Arnie… “I will be back”…”– Nick James – www.nickjamescopy.com

"Nick Winton – “This course teaches you how to take a company that is in a bit of trouble and instantly turn it into a cash positive company. I have done an MBA & the tools there are nothing to what Jeremy has to offer”"

- Nick Winton

“Do one deal and your life will change. I can guarantee that. The course is jam-packed with really good advice. The mindset change that you have after the course and in your approach to business I think will change quite radically.”

Beverley Merriman – Managing Director at Wixel

"Karl Whitfield – “It is an excellent course – I highly recommend it. This is not some text book accountancy by numbers kind of thing or a run of the mill learning… this is nitty gritty, spit and sawdust real world stuff. This is how it is done. Real businesses, real problems and how to fix them.”"

- Karl Whitfield

Lets look at the case study of Craig Boddington – How did Craig buy his first business for £1?

Craig joined the Harbour Club after coming from a consultancy background in helping companies that were merging to integrate their systems.

He was only earning £300,000 a year at that time and realised that he was selling his time for money there was not much room for improvement without more stress.

He also felt that he was not really his own boss as he could not just get up at what ever time he felt like, he was contracted in to do the job.

Craig saw Jeremy speak at a business event, and decided that the Harbour Club sounded like the thing for him.

Before boarding the private jet on the way back from the Spanish island of Mallorca where Harbour Club training was being held, he decided to send off an email to all his outlook contacts.

By the time the plane had landed he already had two leads to chase up, and using the methods taught in the Harbour Club found two more.

Within two weeks from the moment that jet hit the tarmac, Craig had done his first deal where he had bought a company for £1 and sold it for a staggering £250,000 not bad for two weeks work in the middle of a learning curve.

Before it had taken him nearly all year to make that kind of money. In the following 18 months he had managed to close a total of 8 deals buying each company for £1 and managed to flip 6 of them for a 6 figure sum each.

He is now one of Jeremy’s business partners and helps coach and mentor other Harbour Club students to help them achieve the same results that he has managed to achieve using Jeremy’s methods.

"Dan Priestley – I loved the first Harbour Club, it was brilliant! We bought and sold a fairly substantial technology company all within 10 months which was a game changing deal!"

- Dan Priestley"Jonathan Jay – I bought a 4.7 million revenue business for a pound!"

- Jonathan JayJeremy

Just like to say a big thank you for sharing your experiences and teaching me about doing deals.

I came back from the course feeling like I was on a cloud. I have already arranged a meeting to make an offer on my first acquisition £14.5m t/o logistics company.

They are keen to sell to me and I’m going to make an offer next week. I am also working on an offer for a £300m t/o Global logistics company and I am in discussions with the Vice President who is onboard with my idea. He will become the President once I take over. I am in the process of raising funds.

I wouldn’t of done any of this without doing the Harbour Club it was the best thing I ever did. Thank you so much.

Kind Regards

Graham Hayes

Director

Courier Post Logistics Ltd

"Lee Smith – The Harbour Club has by far been the best, life changing event I have ever been on."

- Lee Smith"James Downton – I highly recommend it. It’s changed my business for the better and allowed me to create a lot of wealth."

- James Downton"Chris Isbell – So far I’ve been really pleased with how everything’s been going!"

- Chris Isbell"Allan Presland – I thoroughly recommend it, it’s been an absolute game changer for me and my business!"

- Allan Presland"Marco Soares – It’s been a great course!"

- Marco Soares"Wynand Lindeque – This is a great course to come on!"

- Wynand Lindeque"Alan Gitsham – If you are thinking of getting involved in turning companies around or looking for opportunities for investment I’ll recommend it!"

- Alan Gitsham"Oliver Mason – Thoroughly enjoyed it, learnt loads of great stuff about how to buy businesses…"

- Oliver Mason"Louis Ques – I recommend it to everyone whos interested in acquiring businesses and to improve their sales and profitability."

- Louis Ques"Freddie Rayner – I must say it was a really fantastic course, without a doubt one of the best courses I have ever been on!"

- Freddie Rayner"Darran Kennedy – The content was pretty amazing in terms of how you go about structuring deals. I’ve been in this position before and not seen any tactics like this before."

- Darran Kennedy"Wayne Tica – Coming on this course has been a real eye-opener. The take-away items I’ve learned in the last two days are just mind-blowing. I’m not going to be able to sleep tonight to be honest, trying to think of the possibilities!

- Wayne Tica"Nitin Patil – I came for Jeremy’s course with some expectations and they were all met in terms of structuring the deals and doing the financial re-structuring and a lot of new techniques and ideas."

- Nitin Patil"Trevor Mapondera – The content, the knowledge pays for itself. In my situation, it paid for before I even got here!"

- Trevor Mapondera"Edgaras Adomaitis – The market is huge and the opportunities around, so we just need go and do."

- Edgaras Adomaitis"Michael Mayr – It wasn’t easy for me to get here, but, you know what, the commitment is, is what it takes to get you here. So, I would say, make it and get to this course. You won’t regret it. That’s for sure."

- Michael Mayr"Stuart Mellody – The experience has been phenomenal. It’s been very positive. Enormous amount of information. It’s really valuable."

- Stuart Mellody"Robert Neal – Jeremy’s class was very enlightening and there’s almost too much information there for my brain to handle right now. So, I’ll spend the next few days processing information, putting it to work and I look forward to working with Jeremy."

- Robert Neal"John & Suzanne Edwards – Jeremy was absolutely brilliant. It’s better than what I expected. Absolutely phenomenal and real value for money."

- John & Suzanne Edwards"Michael Haston – It’s a game-changer and anybody looking to go up the next level from starting a business from scratch, moving on from that to buying and selling businesses, this is where you need to be. Simple as that."

- Michael Haston"Mike Howard – Excellent! Loads of information. Over-delivered on everything that I anticipated. Take the first step. You won’t be disappointed."

- Mike Howard"Marco Robert – Not only did Jeremy actually super-exceed my expectations, it beyond that. We learned strategies here that are not available to anyone. We learned strategies here that only the super-rich have access to."

- Marco Robert"Richard Brady – The course is superb. I highly recommend it to anybody. I think it’s cheap for what you get. So, fantastic. Really very, very good."

- Richard Brady"Stacy Flick – These three days have been a real eye-opener. The content itself is, blew me away. Huge value."

- Stacy Flick"Barbara Spurrier – The Harbour Club course was very inspirational and has left me with my brain spinning with ideas and wanting to execute some of the ideas I now have."

- Barbara Spurrier"Sascha Janzen – It’s a lot of valuable content delivered by a very experience deal-maker. So it’s all authentic, realistic and doable."

- Sascha Janzen"Simon Berry – I’m very confident that I’m going to be able to do a lot with what I’ve learnt and people will hold me accountable."

- Simon Berry"Natalie Macaulay – To be in a room with people who are questioning, like I am, the quality of discussion is incredible. Literally, I’m learning from every person I talked to."

- Natalie Macaulay"Claire Jarrett – I looked up Jeremy Harbor’s course and I am so glad that I came. Because the number of techniques that Jeremy has been teaching us is absolutely incredible. I’ve already booked on to go again a second time because there is just so much information to take in."

- Claire Jarrett"Patricia Bird – The people that contributed to the Harbor Club, I’m really indebted to them because I know that if I wasn’t here today, I wouldn’t have learned how to do the deals, put the deals together and that I have learned and I’m still learning."

- Patricia Bird"Yuksel Dogan – If you’re an entrepreneur, I would advise you to come to take a look, definitely. And also the networking, it’s fantastic. We met quite some people so it was a success for me, definitely."

-Yuksel Dogan"Stephen Kennedy – There are many other tools that I have learned that will add even more value but it’s been absolutely well worth three days."

- Stephen Kennedy"John Roberts – It offered a unique set of experiences that were to deliver the systems that I’m looking for. So I’m really keen to go back to Australia and apply these systems."

- John Roberts"Erdal Gul – It’s unbelievable, the content and also the network, the people you meet, and it’s wonderful. So I’m really glad I decided to join and I’m really advising and recommending other people who hesitate to decide and go ahead with the course."

- Erdal Gul"Robbie Smith – You meet such a huge range of people. Not just attendees, but also people who’ve done the course, done deals. If anyone’s thinking of whether to do it, I’d say absolutely, go for it. You’re not going to regret it."

- Robbie Smith